nj property tax relief check 2021

For mobile home owners site fees must have been paid by Dec. Taxes are due February 1 May 1 August 1 and.

State Of Nj Department Of The Treasury Division Of Taxation

Web This page is for Income Tax payments filings and inquiries - as well as for repayments of excess property tax relief benefits Senior Freeze or Homestead BenefitIt cannot be used to make Inheritance or Estate Tax payments.

. Farmers and fiscal year filers see the instructions for Form NJ-1040-ES for information on due dates. For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy said. Web See note at the end.

Waterford in Camden County up 84 to 393. Phil Murphy and his fellow Democrats who lead the New Jersey Legislature have announced an expansion of the property tax relief program. Go here if you want to pay other taxes online.

So this is the latest version of Individual Tax Instructions fully updated for tax year 2021. COVID-19 is still active. Web Homeowners also must have fully paid their 2020 property taxes by June 1 2021 and 2021 property taxes must be paid by June 1 2022.

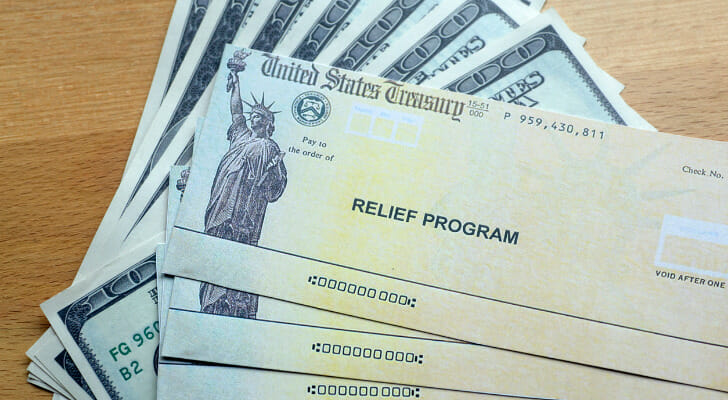

Property Tax Relief Programs. How to Make an Estimated Payment. Treasury Announces NJ Division of Taxation Extends Filing Payment Deadlines for Tropical Storm Ida Victims.

Ali Eminov from Flickr. If you do not desire a receipt then mail the property stub and checkmoney order. NJ Tax Relief for Hurricane Ida Victims.

Web Division of Tax Collection. Web Property values however are unique to each property. Fourth quarter property taxes must be received by Thursday November 10 th to avoid interest.

B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit. The Tax Collectors office will have extended hours. Web In 2021 the average New Jersey property tax bill was about 9300.

Web Property Tax Relief Programs. Web 1 best-selling tax software. 1182 Public Law 116-260 116th Congress An Act Making consolidated appropriations for the fiscal year ending September 30 2021 providing coronavirus emergency response and relief and for other purposes.

9284 in 2021 an increase of 172 over the. Based on aggregated sales data for all tax year 2021 TurboTax products. Web Download or print the 2021 New Jersey Individual Tax Instructions Form NJ-1040 Instructions for FREE from the New Jersey Division of Revenue.

New limitations on Urban Enterprise Zone Exemption Certificates. Public Hearing Notice FY2020 Model Plan Amendmentpdf 12kB LIHEAP Detailed Model Plan FY2023 pdf 210kB LIHEAP Handbook v2 pdf 275. State Tax Forms.

Property Tax Bills Property tax bills are mailed once a year in September and contain four quarterly payment stubs. 1 online tax filing solution for self-employed. Web Quarterly taxes were due November 1 2022.

Web The Senior Freeze Property Tax Reimbursement program reimburses eligible New Jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence home. Due to the volume of claims please allow up to 30 days for a replacement. Please make checks payable to the City of Linden.

To lower your tax exposure you need to lower the assessed value. If you are mailing a payment you must file a Declaration of Estimated Tax Voucher Form NJ-1040-ES along with your check or money orderMake. Web There were 122 towns with more Senior Freeze checks in 2020 than in 2015.

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program replaces the Homestead Benefit for the 2019 tax year. Self-Employed defined as a return with a Schedule CC-EZ tax form. Based upon IRS Sole Proprietor data as of 2022 tax year 2021.

For mobile home owners site fees must have been paid by Dec. Note that interest charges on payments made after the grace period are calculated back to the November 1 st due date. Web For information about Property Tax Relief Programs click here.

Stay up to date on vaccine information. Millville in Cumberland County up 83 to 732. The deadline for 2021 applications was October 31 2022.

4 TH QUARTER PROPERTY TAXES MESSAGE. The Tax Assessor can be reached at 856 429 7767. Web The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate.

Although property taxes are levied at the local level concerns about high property taxes were thought to be among the leading factors that led to last years near upset of Murphy. Web Resident Service Members. Final New Jersey Low Income Household Water Assistance Program LIHWAP Model Plan.

Influence on 2021 governors race. In order to appeal you must file by April 1 and taxes must be current through the first quarter of the year. Web NJ expands effort to ease local tax burden as those bills keep climbing.

Web You can also request a check tracer for your New Jersey Income Tax refund check for the current year by calling the Divisions Automated Refund Inquiry System at 1-800-323-4400 Touch-tone phones within NJ NY PA DE and MD or 609-826-4400 touch-tone phones anywhere. The last day to pay without interest was November 10 2022. Web Homeowners also must have fully paid their 2020 property taxes by June 1 2021 and 2021 property taxes must be paid by June 1 2022.

Only for the August quarter you will receive a separate estimated tax bill mailed in June. CC BY-NC 20. Web NJ Income Tax Resource Center.

The 10 biggest gains. Covid19njgov Call NJPIES Call Center for medical information related to COVID. 2021 Senior Freeze Payment.

The filing deadline for the 2018 Homestead Benefit was November 30 2021. If you are a resident service member stationed out-of-State and buy a car outside of New Jersey but wish to title the vehicle in New Jersey you may defer payment of Sales Tax until the vehicle is brought to New JerseyYou must first complete a Military Sales Tax Deferment Application Form MD-1 have it notarized. You can make an estimated payment online or by mail.

Complete this questionnaire to see if you may be eligible for a 2021 Senior Freeze. Save Time - Sign up to auto draft your tax payments now. The Office of the Tax Assessor can help you file your appeal.

Any payment received after 4 PM on Thursday November 10 th in the Tax Collection Office 900 Leonardville Road or by 4 PM online will accrue interest from the statutory due date of Tuesday November 1 st and additional Tax Sale. Web a Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. New Jersey Extends 2021 Tax-Filing Deadline for Kentucky Tornado Victims.

If this is your first time filing a tax return with New Jersey you cannot use this portal to.

Tax Finance Dept Sparta Township New Jersey

Murphy Announces Details Of Property Tax Relief Program Whyy

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

New Jersey Governor Floats Property Tax Relief For Homeowners Renters

Tax Collector S Office City Of Englewood Nj

The Official Website Of City Of Union City Nj Tax Department

Tax Utilities Official Website Of The Borough Of Glassboroofficial Website Of The Borough Of Glassboro

Stimulus Checks And Tax Rebates Available In 17 States Money

What States Are Paying A Fourth Stimulus Check Smartasset

Is A 4th Stimulus Check Coming From Your State Gobankingrates

Bigger Tax Relief Likely Amid Unprecedented Nj Revenue Surge

Nj Property Tax Relief Program Updates Access Wealth

Property Tax Calculator Estimator For Real Estate And Homes

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Nj Property Tax Relief Program Updates Access Wealth

Here S How Much You Would Get In N J Property Tax Rebates Under New Murphy Plan Nj Com

Stimulus Update 2022 These States Are Proposing Payments To Residents This Year Nj Com